(NHAI) National Highway Authority of India has finally approved national highway status to 28 kilometres long Dwarka Expressway starting from Shiv Murti in Delhi to Kheri Daula in Gurgaon or Gurugram city. This notification has come after over a year. NHAI has also specified the speed limit of 80 kmph on the expressway. Once completed the road will develop as an alternate route between Delhi and Gurgaon, and is expected to reduce the traffic load on the Delhi Gurgaon Expressway. The move is also expected to further the completion of this much delayed project.

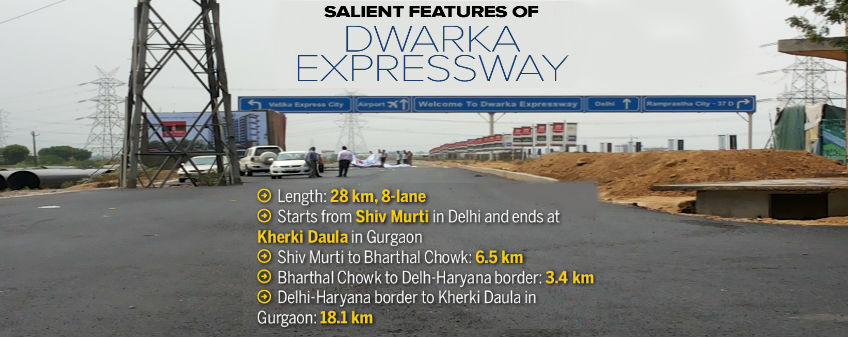

Dwarka Expressway was planned as an alternate route between Delhi and Gurgaon, and is expected to reduce the traffic load on the Delhi Gurgaon Expressway. Starting Shiv Murti in Delhi on NH-8, the expressway passes through UER-II (parallel to terminal – 3 of the Indira Gandhi international Airport) up to Barthal Chowk, from where it stretches to kheri daula in Gurgaon, culmination at NH-8, around one km before kheri daula toll plaza. Of the 28 km, around 18 km stretch of the road is in Gurgaon while rest is in Delhi. NHAI official informs that the authority has started land acquisition for a 2.1 km stretch in Delhi. Total of around 24 hectares of land will be acquired to complete the delhi portion of the expressway. Rest of the land is under the Delhi Development Authority (DDA), which will hand over the NHAI soon.

The main road is proposed to be of 8-lane with 3-lane service road on either side. At the intersections flyover has been proposed. In order to avoid traffic jam in future at crossing and junctions NHAI will construct underpass at such spots. “All the major cross road including existing and proposed master road of sectors are supposed to have 4-lane underpasses for smooth movement of traffic.

Developers have expressed their excitement with announcement. National Highway will boost the real estate market in Gurgaon.